A Brooklyn district attorney was forced to resign this week after her appearance on the TV reality show “The Apprentice” began to interfere with her day job. “Obviously, how can I be in a courtroom now, at least while the show is airing?” Mahsa Saeidi-Azcuy, who mostly prosecutes the offenders for misdemeanors in Criminal Court.

Ms. Saeidi-Azcuy didn't want to quit her job, but it became hard to voir dire a jury:

She never told her bosses that she was taking two months off to record the show, apparently hoping that they would never see her mix it up with Donald J. Trump on their televisions once the show was broadcast. And her plan would have worked, if it hadn’t been for the jurors on her cases, who do watch Mr. Trump and began to recognize her after just two appearances on the show.

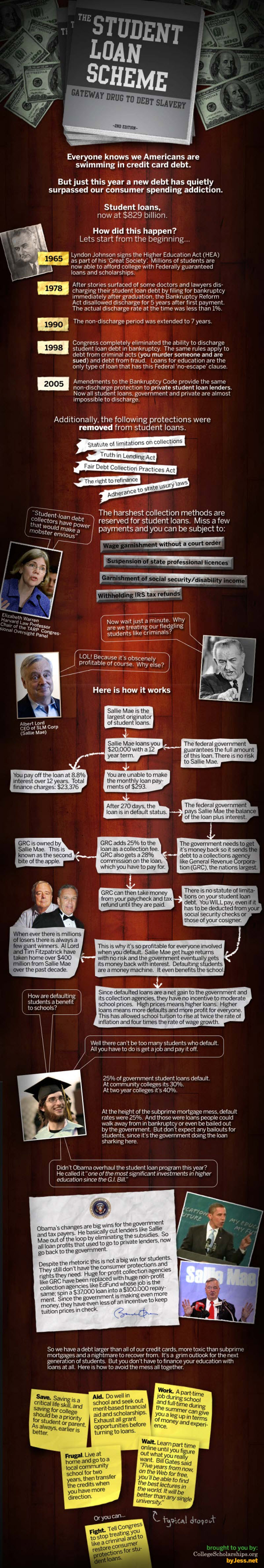

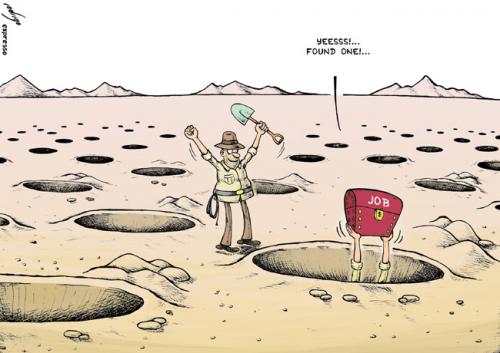

So, I know that The Apprentice this season is focusing on victims of the recession. I realize that The Apprentice is about getting a job with Mr. Trump--but it's a little nutty that she resigned from a job that many BIDER readers would murder for. Come to think of it, why the hell is she on the show anyways? Well, according to her bio, she's the only breadwinner in her home. I'm willing to place a bet that her hubby is a Brooklyn Law Grad as well, and consequently unemployed.

Look! I was right!

In Saeidi-Azcuy's case, her husband works pro bono, so they're forced to live on just one income.So, shouldn't he be on the show and not her? Now they will both be out of work, unless she gets that job working for Mr. Trump. I guess she can always try to be the new Kim Kardashian--the lawyer edition.

When I use to live in NYC, there were always times when I had to walk in pain in my dress shoes because my purse was too small to carry a pair of flipflops to wear after work. Sometimes my feet were in so much pain in my high heels that I would look for any department store just to buy a pair of comfortable shoes for the walk home.

When I use to live in NYC, there were always times when I had to walk in pain in my dress shoes because my purse was too small to carry a pair of flipflops to wear after work. Sometimes my feet were in so much pain in my high heels that I would look for any department store just to buy a pair of comfortable shoes for the walk home. What is so great about this product is that it fits into most purses and handbags. That means you can bring CitySlips with you even when you're not carrying your huge tote or gym bag. These shoes are very comfortable and each pair comes with a pouch that unfolds into a carrying tote to put in your heels. I love this product and carry it around with me everywhere I go. It's such a relief not to lug around a pair of sneakers in my purse and be able to fit a pair of comfortable shoes in even a clutch purse. This is a must have accessory for busy women looking for a stylish alternative to the usual boring flip flops and sneakers you see women around your city wear after work.

What is so great about this product is that it fits into most purses and handbags. That means you can bring CitySlips with you even when you're not carrying your huge tote or gym bag. These shoes are very comfortable and each pair comes with a pouch that unfolds into a carrying tote to put in your heels. I love this product and carry it around with me everywhere I go. It's such a relief not to lug around a pair of sneakers in my purse and be able to fit a pair of comfortable shoes in even a clutch purse. This is a must have accessory for busy women looking for a stylish alternative to the usual boring flip flops and sneakers you see women around your city wear after work.